Woohoo Bank Working And Winning with AI and Automated Machine Learning

Banks have always relied on predictions to make their decisions. Estimating the risks or rewards of making a particular loan, for example, has traditionally fallen under the purview of bankers with deep knowledge of the industry and extensive expertise. But times are changing.

At Woohoo Bank, we realize that data science can significantly speed up these decisions with accurate and targeted predictive analytics. By leveraging the power of automated machine learning, Woohoo Bank have the potential to make data-driven decisions for products, services, and operations.

Woohoo Bank Empowering Our Customers

Know how you spend, then help yourself do it better. With all your accounts in one place and simple, categorized transactions, you are more able to plan ahead and budget, creating financial goals for the future.

- Financial Goals.

- Planning & Budgeting Tools.

- Account Aggregation.

- Transaction Categorization.

- Spending Analysis.

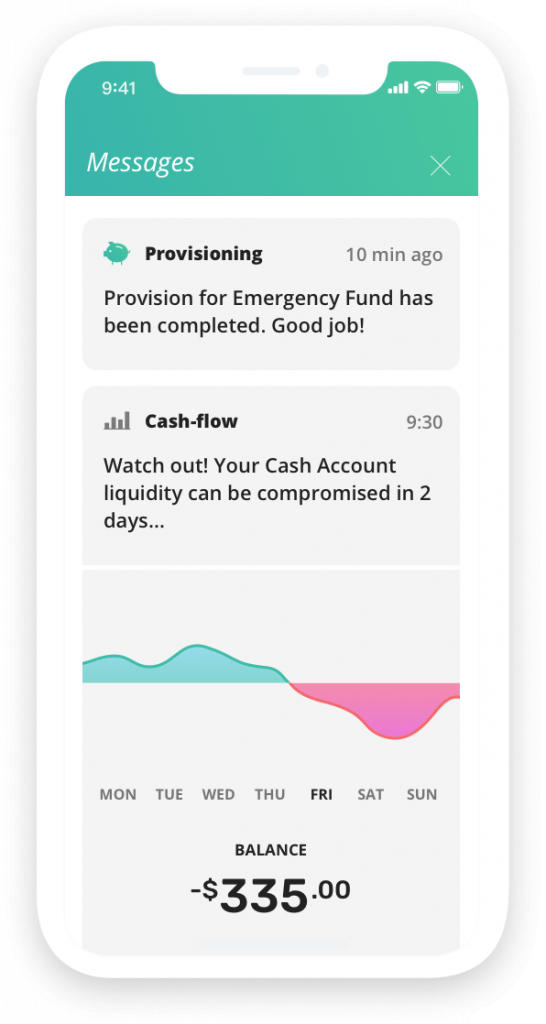

Be The New, Smarter Spender

The day-to-day of money management made easy with cash flow forecasting and financial summary tools. Woohoo Bank gives visual insight about where every cent goes each month and the ability to benchmark with peers, whilst promoting smarter spending.

- Financial Summary.

- Cash Flow Forecast.

- Peer Comparison.

Bespoke Banking, Without The Surprises

We eliminate the element of surprise from our customers’ financial future with personalized alerts, offers and recommendations. Anticipate and avoid potential issues whilst improving money management habits.

- Personalized Financial Advice.

- Financial Product.

- Recommendations.

- Alerts & 3rd-Party Recommendations.