Roche Fintech Working And Winning with AI and Automated Machine Learning

Banks have always relied on predictions to make their decisions. Estimating the risks or rewards of making a particular loan, for example, has traditionally fallen under the purview of bankers with deep knowledge of the industry and extensive expertise. But times are changing.

At Roche Fintech, we realize that data science can significantly speed up these decisions with accurate and targeted predictive analytics. By leveraging the power of automated machine learning, Roche Fintech have the potential to make data-driven decisions for products, services, and operations.

Open Hub

A simple interface which leverages Open Banking to connect multiple external services securely in one place. One platform offering customers an overview of their finances and the ability to connect to third-party services.

Bank Account Aggregation

Become your own’ everyday bank, giving access to all your accounts in one place.

3rd-Party Non-Financial Services

Give access to added-value 3rd-party services for greater convenience in your’ day-to-day lives.

Complementary Financial Services

Complement your banking with additional financial services that you will benefit from.

Integration

Integration with accounting and cash flow management tools such as Quickbooks and Xero.

Management capabilities

Retain more info, boost revenue, cross & upsell, and improve your financial management capabilities.

Offers and services

All account information in one secure place. Get the best offers and services from 3rd-party providers.

BUSINESS FINANCIAL MANAGEMENT

Giving SMEs Control

offer a solution aimed at the 3 main issues all businesses face: money management, accessing lending and scaling their business successfully, or Buy, Operate & Sell.

Day-to-Day

One platform from which to synchronize all accounting and invoicing, create tax provisions, prepare for fluctuating cash flow and carry out their business, stress-free.

State of the Art

Customer insights give business owners the opportunity to understand their customer base, define better marketing campaigns and spot opportunities for growth.

Empowering your Customers

Know how you spend, then help yourself do it better. With all your accounts in one place and simple, categorized transactions, you are more able to plan ahead and budget, creating financial goals for the future.

- Financial Goals.

- Planning & Budgeting Tools.

- Account Aggregation.

- Transaction Categorization.

- Spending Analysis.

Bespoke Banking, Without The Surprises

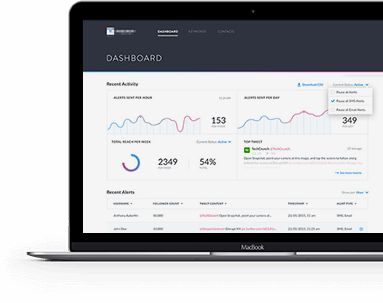

We eliminate the element of surprise from our customers’ financial future with personalized alerts, offers and recommendations. Anticipate and avoid potential issues whilst improving money management habits.

- Personalized Financial Advice.

- Financial Product.

- Recommendations.

- Alerts & 3rd-Party Recommendations.